Methods of Valuation of Human Resources

The main methods of measuring the value of human resources are given below:

1. Historical or Actual Cost Method. ( developed by William C. Pyle and R.G. Barry Corporation).

It is on the basis of actual cost incurred on human resources. Under this method, the amount actually spent on the recruitment, familiarization and development of employees is capitalized and amortized over the period for which the benefits are expected to flow to the organization. Certain part of costs will be written off in proportion to the income of the future years which those human resources will provide service. When these human assets are prematurely liquidated, the amount not written off is charged to income of the year in which such liquidation takes place. Outlays which are not having value beyond the current accounting period are treated as operating expenses. Costs on recruitment, selection and placement are called acquisition costs while the costs of orientation and training are known as learning costs.

Advantage

i. It is very simple in its application.

ii. The effect of human resource accounting can be shown on conventional Balance Sheet and Loss Account because the information in these statements is also stated on historical cost basis.

Disadvantage

i. It is difficult to estimate the number of years over which the capitalized expenditure is to be amortized.

ii. It considers only the employee’s acquisition cost and ignores the aggregate value of their potential services.

iii. It is difficult to determine the rate of amortization.

iv. The economic value of human resources increases over time as the people gain experience. But in this approach, the capital cost decreases through amortization.

2. Replacement Cost Method (1st suggested by Rensis Likert, was developed by Eric G. Flamholtz)

Under this method, human assets are valued at which it would cost the organisation to replace the existing human resources with human resources capable of rendering equivalent services. In calculating the replacement cost, both acquisition and learning costs are taken into account. It includes communication of job ability, pre-employment administrative functions, interviews, testing, staff meetings, travel cost, employment medical examination etc. As against historical cost methods which take into account the actual cost incurred on employees, replacement cost takes into account the notional cost that may be required to acquire a new employee to replace the present one. Replacement cost is generally much higher than the historical cost.

Advantage

i. This approach is more realistic as it incorporates the current value of company’s human resources in its financial statements prepared at the end of the year.

Disadvantage

i. The replacement value is affected by subjective considerations and therefore the value is likely to differ from one another.

ii. It is not always possible to find out the exact replacement of an employee.

iii. This method does not reflect the knowledge, competence and loyalties concerning an organization that an individual can build over time.

3. Standard Cost Method (David Watson suggested this method)

Instead of using historical or replacement cost, many companies use standard cost for the valuation of human assets just as it is used for physical and financial assets. Under this method, employees of an organization are categorized into different groups based on their hierarchical positions. Standard cost is fixed for each category of employees and their value is calculated. This cost is updated every year. Replacement costs can be used to develop standard costs of recruitment, training and developing individuals.

Advantage

i. It is quite simple method.

Disadvantages:

i. It fails to take into account differences in employees put in the same group. In many cases, these differences could be very vital.

4. Current Purchasing Power Method

Under it, instead of taking the replacement cost to capitalise, the capitalised historic cost of investment in human resources is converted into current purchasing power of money with the help of index numbers.

Advantage

i. It is simple method.

Disadvantage

i. It is difficult to find suitable index in the changing scenario therefore, this method may not be representative of actual value of human resources.

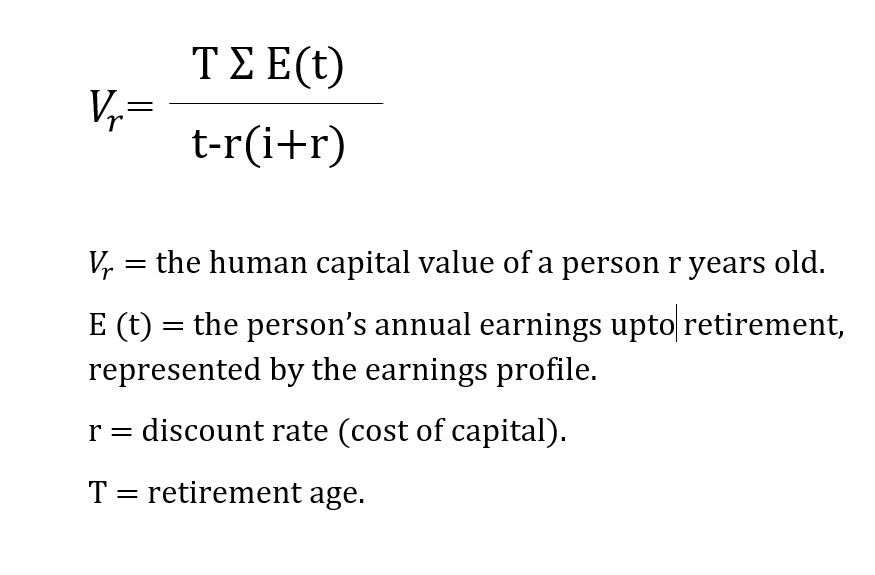

5. Present Value Method or Economic Cost Method

Under this method the future earnings of various grades of employees are estimated upto the age of retirement and are discounted at the rate of cost of capital to obtain their present value.

The model may be expressed as follows:

Values are arrived at on the basis of average earnings for each category of employees.

Steps involved

i. All employees are classified in specific groups according to their age and skill.

ii. Average annual earnings are determined for various ranges of age.

iii. The total earnings which each group will get upto retirement age are calculated.

iv. The total earnings calculated as above are discounted at the rate of cost of capital. The value thus arrived at will be the value of human resources/assets.

Advantages

i. Human capital calculated in this manner is useful since comparison with non-human capital will give an idea about the degree of labour intensiveness.

ii. Depending on the rate of growth in human capital one can also say whether an organisation has an ageing labour force or a younger labour force.

Disadvantages

i. The discount rate to be used cannot be calculated with a high degree of objectivity.

ii. This method does not give correct value of human capital as it does not measure its contribution to achieving organizational effectiveness.

6. Asset Multiplier Method

This method is based on the assumption that there is no direct relationship between costs incurred on an individual and his value to the organisation at any particular point of time. In fact, there are other factors such as motivation, attitude and working environment that affect the value of an individual. Under this method, organisational employees are divided into four categories: top management, middle management, supervisory management, and operative or clerical employees. Wage and salary bill for each category is multiplied with an appropriate multiplier to calculate the total value of each. Multiplier is a means for relating the personal worth of the employees to the total assets value of the organisation. It should be rather obvious that the highest multiplier would be attached to the senior management grade while the lowest multiplier would be used for operative and clerical grades. Since this method makes use of multiplier to calculate the asset value, it must be checked for realistic accuracy and consistency.